1. Introduction

The Spot market with short term physical delivery consists of two markets with fundamentally different market designs:

Auction-based trading, including the Day-Ahead auction and Intraday auctions.

Continuous Intraday trading, where orders are matched in real time until shortly before delivery.

The following post will be about the auction based trading, focusing on the Day-Ahead auction.

2. Auctions of the Spot Market

Day Ahead Auction The most significant auction in the electricity market is the Day-Ahead auction, which takes place daily and determines electricity prices for the following day. This auction runs on 15 mins Market Time Units (MTUs), meaning that prices are being determined for all 96 quarter hours of the delivery day. Order books close at 12:00 CET with auction results being published around 13:00 CET.

As the first and still the most influential auction, the Day-Ahead price serves as the benchmark for financial contracts like futures and many OTC agreements. Generally, the outcome of this auction is considered the “spot price” for electricity markets.

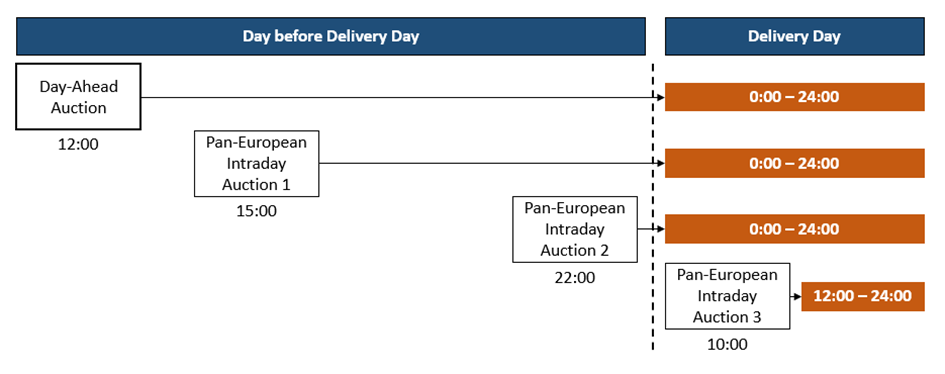

Intraday Auctions Complementing the Day-Ahead auction, European market operators (NEMOs) conduct three Pan-European Intraday auctions daily (with local variations depending on the market area). These auctions take place closer to the actual delivery period and allow market participants to refine their positions as forecasts become more accurate. Delivery periods can be as short as the imbalance settlement period of the respective market area (e.g. German Intraday auctions clear at 15 mins resolution, while the Day-Ahead auction clears at 60 mins). The following graphic illustrates the timeline of European coupled auctions.

Graph: Timeline of coupled European auctions with time of order book closure and delivery period. Timings expressed in CET/CEST.

3. Bidding in the Auction Markets

Market participants submit buy and sell orders before the order book closes. Each auction operates within minimum and maximum price limits, ensuring price stability while allowing for market fluctuations. In the Day-Ahead auction, the current price limits are:

Maximum price : 4,000 €/MWh

Minimum price : -500 €/MWh

These limits adjust automatically in response to extreme market conditions.

Over time, various order types have been introduced to help market participants reflect the technical constraints of their assets, such as power plants or batteries. Below are some of the most common order type.

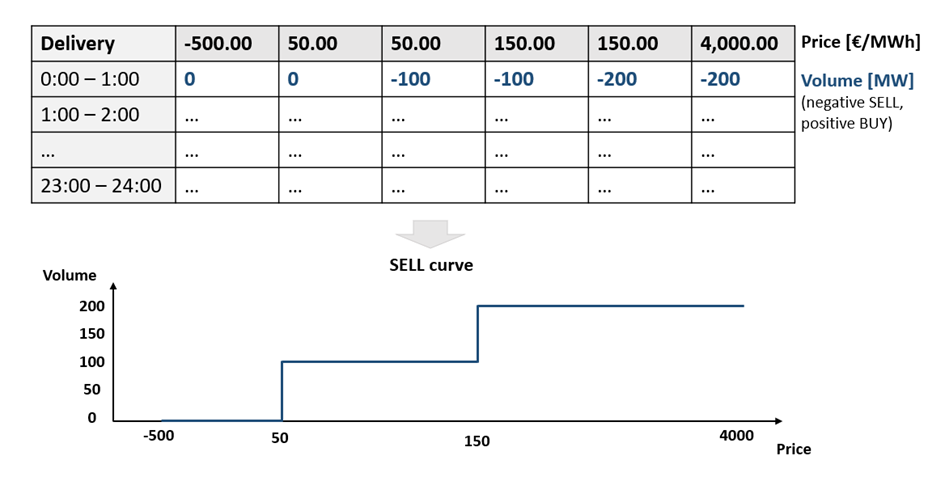

Linear/Single Orders With this order type, participants specify the volume they are willing to buy or sell at different price levels, within the defined min-max price range. The following example shows a possible order that expresses the willingness to sell 100 MW if the price is higher than or equal to 50 €/MWh and 200 MW if the price is higher than or equal to 150 €/MWh. Each linear/single order applies to one delivery period only.

Graph: Construction of a sell order with different volumes at different prices

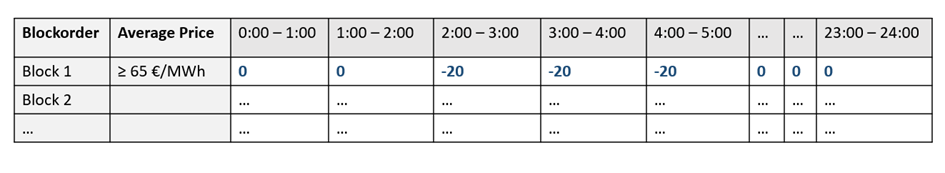

Block Orders Block orders allow participants to link multiple delivery periods together, ensuring that either the entire block is executed or none at all. This type of order is crucial for generation assets that cannot ramp up or down quickly between delivery periods.

The example below is showing a block order where a market participant is willing to sell a constant 20 MW from 2:00 – 5:00 only if the average price in those hours is at least 65 €/MWh. If executed all the sell volumes of the three periods will be executed, if not, none will be executed.

Linked Block Orders Some assets require more complex execution conditions. Linked block orders allow participants to define dependencies between multiple blocks, such as:

Conditional Execution : One block order is executed only if another block is also executed.

Exclusive Execution : A set of blocks is submitted, but only one of them can be executed.

All-or-Nothing Execution : Either all linked blocks are executed, or none of them are.

These options allow for more efficient optimization of generation assets and energy storage (e.g., batteries).

This is just showing the most common orders and the idea behind it. With the evolving power system also market participants requirements for order types are changing. In general order types are becoming more and more complex to give more freedom to market participants.

4. Market Coupling and Cross-border Trading

Market Coupling The Day-Ahead auctions in EU-countries (plus Norway) are integrated into the Single Day-Ahead Coupling (SDAC) mechanism. This means that one auction runs simultaneously for all market areas, and the available interconnector capacity between market areas is automatically considered when calculating prices and trades.

With market coupling, imports and exports are implicitly determined, meaning market participants only place orders in their local market, and cross-border exchanges occur automatically within the auction process. This method ensures that available transmission capacity is allocated in the most economically efficient way, eliminating the need for separate cross-border capacity bookings for most participants. Explicit allocation methods are still used for long-term capacity rights.

NEMOs and Shared Orderbooks NEMOs (Nominated Electricity Market Operators) are responsible for organizing these auctions. In the EU, multiple NEMOs operate across different countries and market areas, often competing within the same region (e.g. EPEX SPOT and Nord Pool share several countries). The full list of NEMOs and their areas of operation can be found on the website of the NEMO-Committee.

Through the Price Coupling of Regions (PCR) initiative, European NEMOs have established a shared order book system. This means that orders submitted to any NEMO in a coupled market are aggregated into a single, unified auction. As a result, market participants benefit from the liquidity of the entire European market, regardless of which NEMO they use to place their orders.

Interconnector Capacities Besides the market participants and their willingness to buy or to sell certain volumes at certain prices, the algorithm takes into account the capacities of electricity that can be exchanged between the different market areas. This information is provided by the European TSOs.

Results Calculation Once all orders and interconnector capacities are submitted, the market-clearing algorithm calculates results by maximizing global social welfare—which is the sum of:

Consumer surplus (buyers paying less than their bid price),

Producer surplus (sellers earning more than their minimum required price), and

Congestion rent (revenues from limited interconnector capacity).

After the calculation, results are published, and the executed trades are nominated to TSOs via NEMOs and their clearing houses. This ensures that transactions are financially and physically settled efficiently across all coupled markets.

5. Conclusion

The auction-based spot market plays a critical role in electricity price formation and cross-border trading. The Day-Ahead auction remains the primary benchmark for energy pricing, while Intraday Auctions provide flexibility for real-time adjustments. Through market coupling and interconnector optimization, Europe has developed an efficient, transparent, and competitive electricity market.