1. Introduction

The Merit Order is a fundamental concept in electricity market economics, determining how electricity generation is dispatched and priced. Once mostly used by industry professionals, the term gained broader attention during the energy crisis in 2021 and 2022 as the answer to rising electricity prices. The Merit Order model is a great, intuitive model to understand price formation in Europe’s liberalized electricity market.

2. Merit Order Model

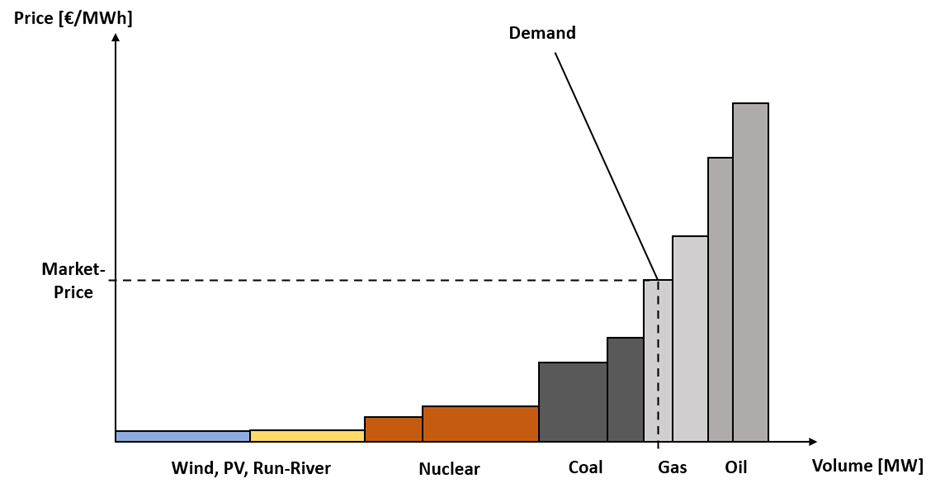

Graphic model The diagram below provides a standard, simplified illustration of the Merit Order model. It consists essentially of two intersecting curves:

The demand curve, representing power consumption at a given moment.

The supply curve, ranking available generation by marginal cost.

The point, where demand equals supply is determining the market price and volume. The graph can only show a specific point in time as demand and generation capacities are changing throughout the day.

Graph: Generic graphical depiction of the Merit Order model

Merit Order While the demand at a certain point is seen as static (consumers today are barely reacting to spot prices), the generation capacity plays the major role in the Merit Order model. The supply curve shows a dispatch of available generation capacity in the most cost-effective way. This is displayed in a curve ranking the available generation capacity from cheapest to most expensive, the so called Merit Order. The costs in that case are the marginal costs of generation one unit of electricity at a given moment.

Marginal Cost of Production As we move along the merit order, from the lowest to the highest marginal cost of generation, we typically see different technologies represented. Renewable energy sources—such as photovoltaic (PV) solar, wind power, and run-of-river hydro—have near-zero marginal costs because they do not require fuel. As a result, they are positioned at the very beginning (left side) of the merit order.

Fossil fuel-based power plants, on the other hand, incur fuel costs, leading to higher marginal costs. Among these, nuclear power generally has the lowest marginal costs per unit of energy produced, followed by coal, natural gas, and oil-fired power plants, which have progressively higher marginal costs.

However, marginal costs are not determined by fuel expenses alone. They also include costs for CO₂ emission certificates, which operators must purchase to offset carbon emissions, as well as other variable operational costs, such as maintenance and efficiency losses. Even within the same technology group, plants with higher efficiency have lower marginal costs, while less efficient plants require more fuel and produce electricity at a higher cost.

It is important to note that the merit order, and thus the dispatch order of power plants, is based on marginal costs alone, not total costs. Power plant operators decide whether to run their plants based on whether the market price of electricity covers their marginal costs. If the price they can obtain for electricity is higher than their marginal costs, they will generate power; otherwise, they will remain offline.

3. Market Pricing Mechanism

Pay-as-Cleared Pricing A key concept illustrated by the merit order model is the pricing mechanism, which is distinct from many other markets. The outcome here is a single market-clearing price at the point where supply meets demand. This means that all electricity producers whose bids are accepted receive the same market-clearing price, regardless of their individual marginal costs. As a result, even low-cost renewable generators receive the price set by the most expensive unit required to meet demand, which is often a fossil fuel-based plant.

Auction-based Spot Market This Merit Order Model is implemented through the Spot Market auction system. Here power producers submit bids based on their expected marginal costs of production. The market-clearing price is set by the highest-cost unit needed to balance supply and demand.

4. Market Impact

Market Implications The merit order model helps explain fundamental relationships and price dynamics in the electricity market. One key correlation is the link between fossil fuel generation and electricity prices. As the merit order illustrates, power plants will only generate electricity if market prices cover their marginal costs.

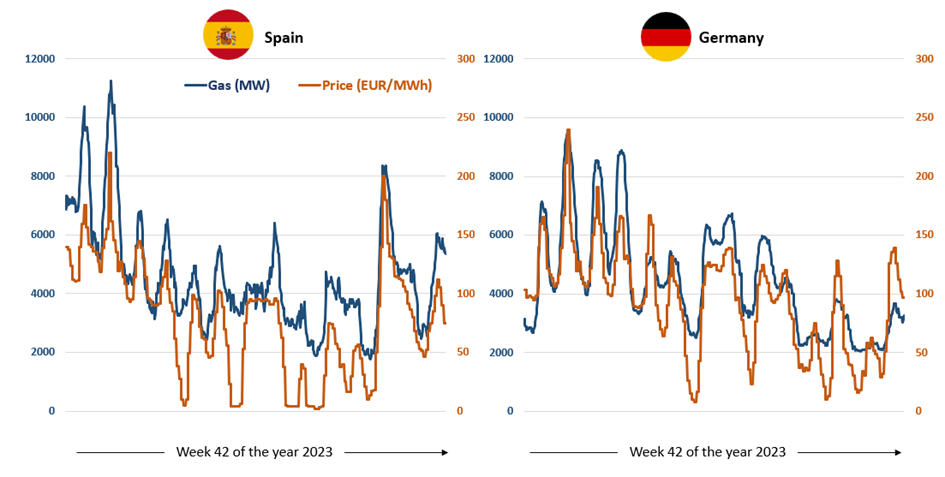

In many markets, dispatchable gas-fired power plants frequently act as price-setting units, meaning they determine the market-clearing price in wholesale electricity auctions. Since gas prices fluctuate due to factors like fuel costs and carbon pricing, electricity prices often follow similar patterns.

The graph below illustrates this relationship by showing gas-fired electricity generation alongside market prices in Spain and Germany during a random week in 2023. The data highlights how gas generation volumes and electricity prices tend to move in tandem, reinforcing the strong connection between fossil fuel costs and electricity market dynamics.

Graph: Hourly electricity price vs. electricity generation from gas units of week 42 (16.10-22.10) in the year 2023 for Germany and Spain

Source: Energy Charts URL: https://www.energy-charts.info/?l=en&c=DE

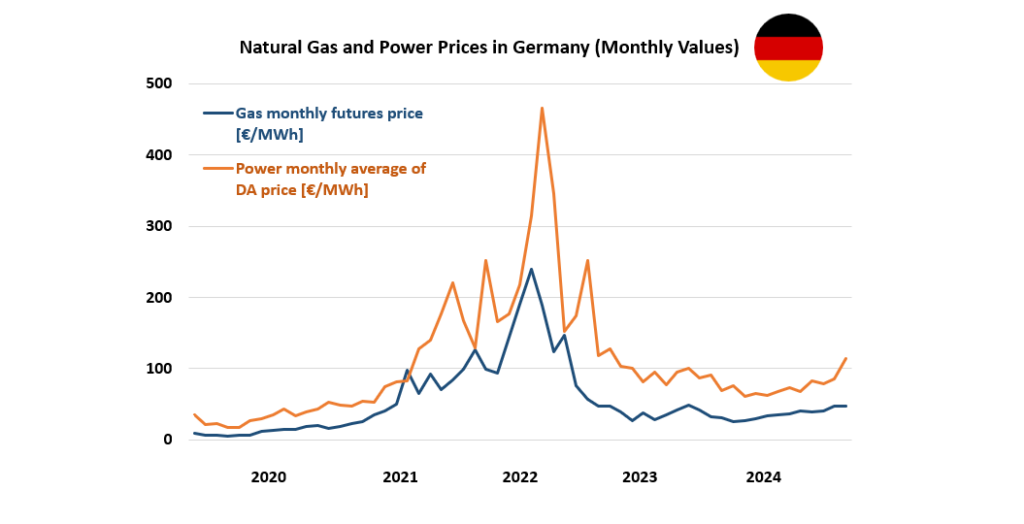

This correlation highlights that electricity prices are strongly influenced by the cost of gas-fired generation. During the 2022/2023 energy crisis, this relationship became particularly evident as record-high natural gas prices led to a sharp surge in electricity prices across many markets. With gas often acting as the marginal price setter, the extreme volatility in fuel costs directly impacted wholesale electricity prices, underscoring the critical role of fuel and carbon costs in market pricing.

Graph: Monthly gas price vs. electricity price in Germany from 2020-2024

Source: Gas price – investing.com, URL: https://www.investing.com/commodities/dutch-ttf-gas-c1-futures-historical-data

Electricity price: SMARD.de, URL: https://www.smard.de/home

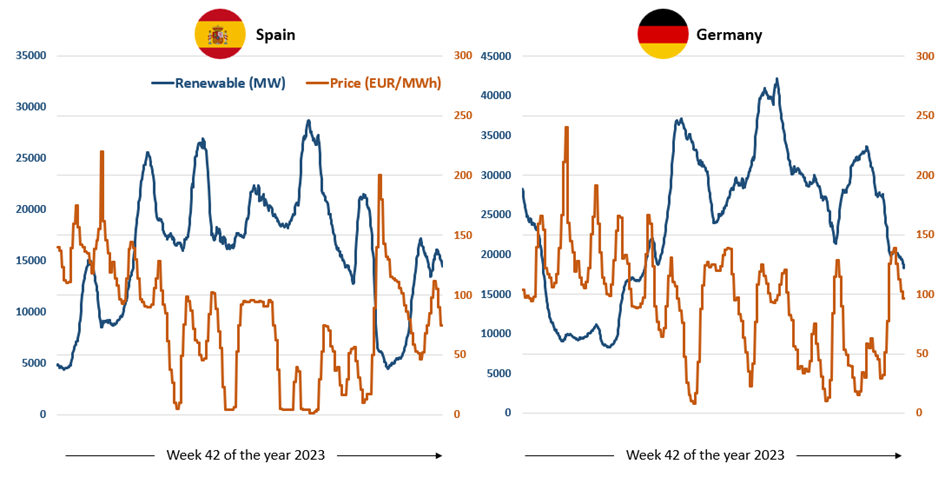

In addition to prices for natural gas, everything that drives up the marginal generation costs of fossil fueled units will in return drive electricity prices. This is the case as well for oil, coal and CO2 emission certificates. At the same time high availability of low marginal costs generation, such as renewables or nuclear will generally drive prices down as can be seen in the graph below for the same week shown above.

Graph: Hourly Electricity price vs. Electricity generation from renewables of week 42 (16.10-22.10) in the year 2023 for Germany and Spain

Source: Energy Charts URL: https://www.energy-charts.info/?l=en&c=DE

5. Future Projections

The transition to a low carbon Electricity system has significant implications for the Electricity market, which can be derived through the Merit Order model.

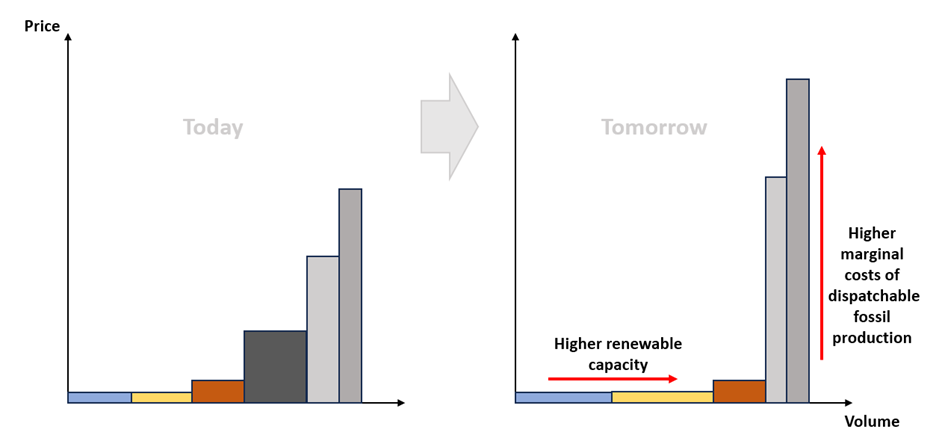

Graph: Generic changes of the Merit Order following future developments

Price Volatility The transition toward a low-carbon electricity system is reshaping market dynamics, as illustrated by the Merit Order model. As countries pursue decarbonization goals, we are witnessing a rapid expansion of low-carbon, low-marginal-cost generation, primarily intermittent renewables like wind and solar. Simultaneously, coal and oil-fired power plants—the most carbon-intensive technologies—are being chased out.

As a result, price volatility is expected to increase. When renewable generation is available electricity prices can drop significantly, often even turning negative. Conversely, during periods of low renewable output, prices can spike dramatically, as the market relies on flexible gas-fired generation. With rising natural gas and CO₂ emission costs, these price peaks may become even more pronounced.

This growing volatility creates new opportunities for storage technologies. As extreme price swings emerge, energy storage solutions like batteries, pumped hydro, and hydrogen will become increasingly profitable, allowing electricity to be shifted from low- to high-price periods.

Security of Supply While renewables with zero marginal costs are gaining market share, their market access poses challenges for the electricity system. As fossil fuel-based dispatchable generation runs less frequently, its ability to recover capital costs diminishes, making new investments in such assets economically challenging.

From a system reliability perspective, maintaining a certain level of dispatchable capacity—such as gas power plants or other long-duration storage—is essential to ensure security of supply during periods of low renewable generation. To address this, several European countries have introduced capacity mechanisms, providing additional revenue streams to ensure that enough dispatchable capacity remains available when needed, even if operated less frequently.

6. Conclusion

The Merit Order is the central principle of electricity markets, influencing generation dispatch and market prices. This market price is determined by the availability of low cost generation capacity at a given moment in time. With the trend to a low carbon power system, price volatility will increase and high marginal costs units are being pushed out of the market. The integration of new flexibility providers such as batteries and the securing of sufficient dispatchable capacity will be the major challenges for market participants and policy makers.