1. Summary

Europe’s renewable energy subsidies have driven an impressive buildout of solar and wind capacity over the past decade. However, many of these support mechanisms were designed under market conditions that no longer reflect today’s realities.

By shielding renewable generators from market price signals—especially during periods of negative pricing—subsidy schemes have inadvertently introduced inefficiencies that now threaten both economic rationality and system stability.

In the short term, policy must adapt to allow renewable generation to respond flexibly to oversupply conditions. Over the longer term, the integration of large-scale storage and demand-side flexibility will be essential to stabilize a grid dominated by variable renewable energy. This analysis focuses on the German market, which serves as a leading indicator for broader trends across interconnected European markets.

2. Context and Background

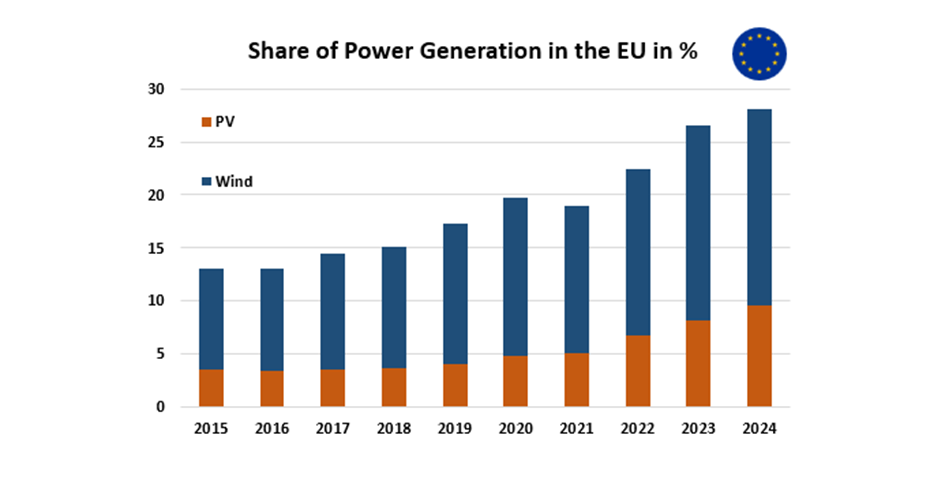

The share of renewable energy in the European energy mix has increased significantly over the last decade. Especially PV and wind generation became a more relevant portion of the mix.

Graph: Development of Wind and PV as percentage of the generation mix in Europe (EU-27)

This expansion was made possible through robust national support schemes—particularly Feed-in Tariffs (FiTs), Feed-in Premiums (FiPs), and more recently, Contracts for Difference (CfDs)—which guarantee fixed remuneration for every unit of electricity produced, independent of real-time market prices.

While these policies were instrumental in de-risking investments and scaling up capacity quickly, they are now facing a structural mismatch with the evolving market environment. Increasing shares of renewables, combined with limited flexibility and legacy baseload assets, are pushing markets into periods of negative pricing—where the system is so oversupplied that generators must pay to remain online.

Germany, where the negative effects of current renewable subsidy structures are most pronounced, is now entering a more decisive phase of policy reform. Under the existing Renewable Energy Sources Act (EEG), fixed remuneration schemes—primarily feed-in tariffs and feed-in premiums—are suspended only after prolonged periods of negative pricing, typically six consecutive hours (or three, depending on the specific contract). While this mechanism was introduced to limit extreme market distortions, its effectiveness has been limited in practice. In response to rising concerns about system inefficiencies and fiscal sustainability, policymakers are now evaluating stricter rules. Preliminary proposals under discussion suggest removing subsidy payments for every market period in which the Day-Ahead price turns negative—regardless of duration. If implemented, this would mark a significant shift toward exposing renewable generators to real-time price signals, encouraging greater alignment between renewable output and system needs.

3. Analysis

3.1. Generation causing negative Prices

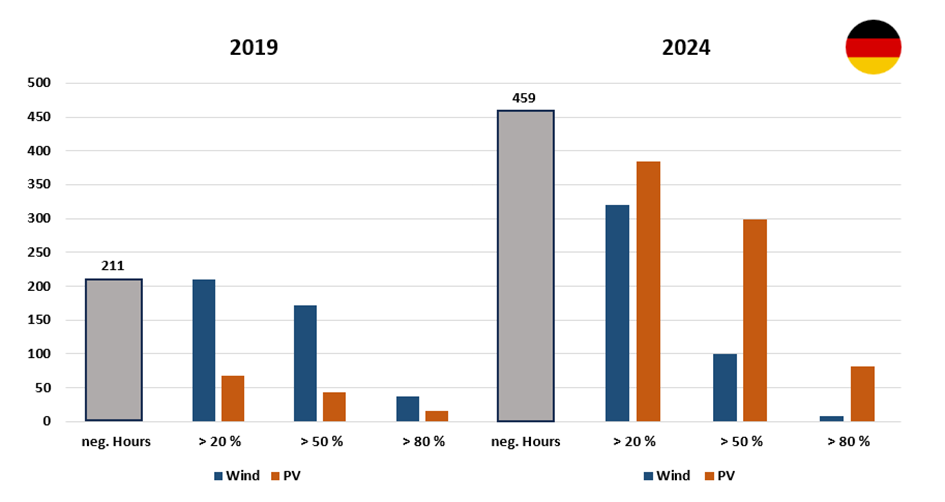

While it is often complex to determine exactly which generation source sets the market price, clear patterns emerge when comparing periods of negative prices with the output levels of wind and solar.

In Germany, for example, data show that negative prices frequently coincide with high renewable output. In 2019, wind played a more significant role, while by 2024, high midday solar output has become the main driver during negative pricing hours. This indicates that despite their technical capability to curtail, many renewable producers continue to inject power even when the market signals oversupply.

These behaviors are economically rational under current subsidy regimes: producers are incentivized to maximize generation volume, not market value, since they receive guaranteed payments regardless of price.

Graph: Number of negative prices in 2019 and 2024 in Germany with the ratio of generation to full capacity of wind and PV during those hours.

3.2. Effects of negative Prices

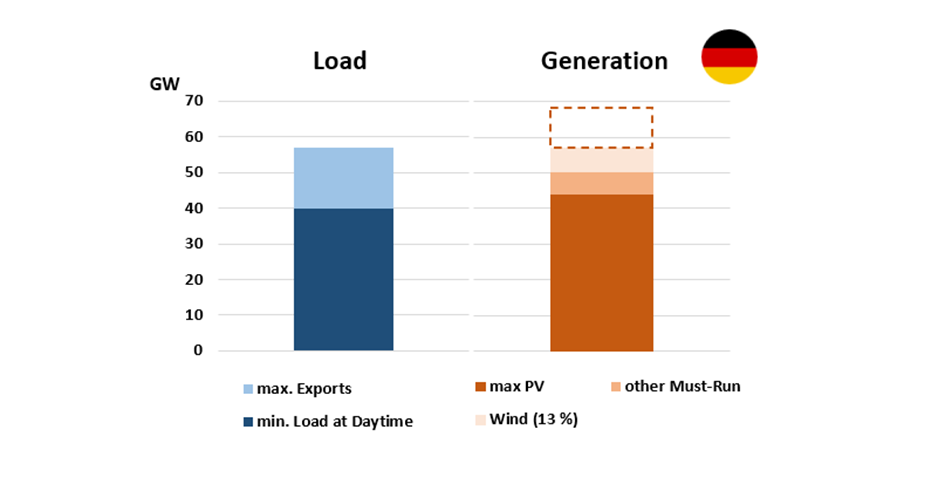

The risk posed by subsidy-induced inflexibility is no longer theoretical. On particularly sunny or windy days, inflexible renewable generation has, in isolated hours, approached or even exceeded total system load. This raises red flags for system operators, who must increasingly rely on out-of-market redispatch and costly balancing measures to maintain stability. The below graph shows 2024 values for Germany where the maximal PV generation together with must-run capacity (mostly fossil) and only 13 % of wind generation would have exceeded the sum of minimal load and maximal exports.

Graph: Comparison of load and generation in a theoretical scenario of oversupply due to high PV generation. Values for Germany, 2024.

Beyond operational challenges, this dynamic creates direct economic inefficiencies. Public budgets continue to fund energy that the market signals as unwanted—often requiring simultaneous payments to curtail other generators or absorb excess power.

3.3. Effects of a theoretical Curtailment of Wind and PV at negative Prices

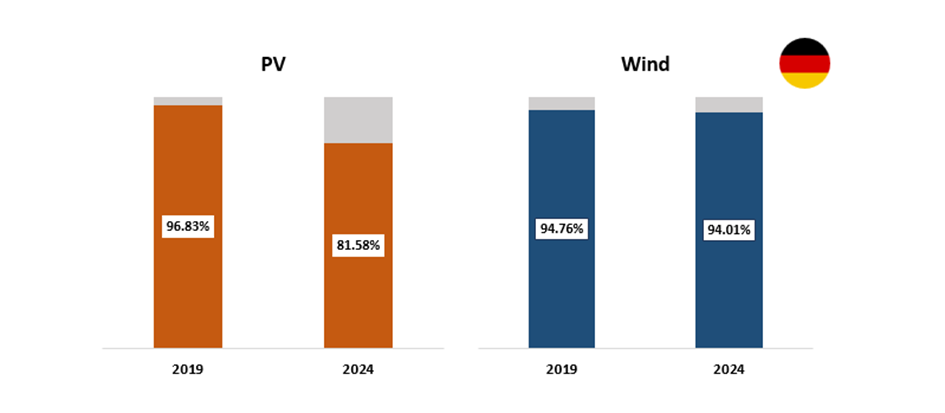

When looking at past data and simply assuming a full curtailment of wind and PV so that negative prices would stay at zero, we can observe that the amount of generated energy would decline for both wind and PV.

For wind we would have about 5-6 % of generated energy less in 2019 and 2024, while PV would see a significant drop in generated energy of almost 20 % in 2024. Assuming a fixed payment per unit of electricity generated this would mean, that revenues of PV would also drop by 20 %. This needs to be taken into account when discussing policy changes as the profitability of renewable investments should not be jeopardized.

Graph: PV and wind generation in case of full curtailment at negative prices. Values for Germany

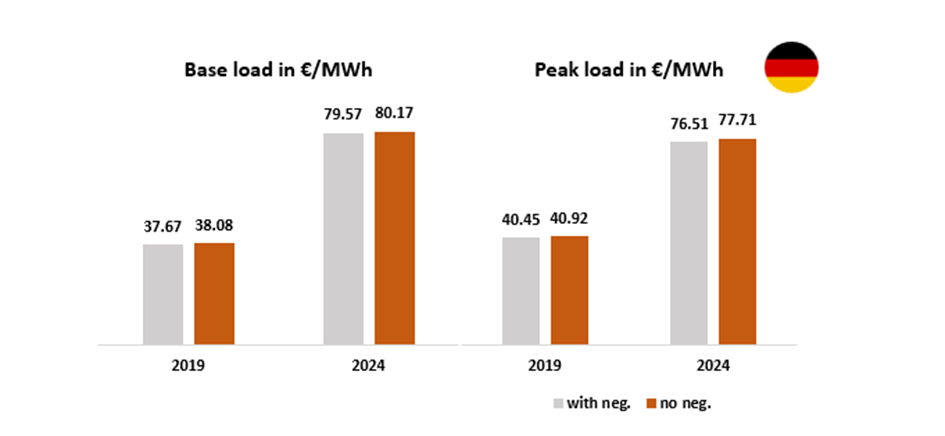

Looking at the two most common indices for Futures contracts base load (average of all hours per year) and peak load (average of all hours from 08:00-20:00 per year) there is no noticeable difference in a theoretical curtailment of wind and PV at a price of zero for the years 2019 and 2024. Assessing the effects on long-term price signals is always important as those are influencing investment decisions on both producer and consumer side.

Graph: Comparison of German base- and peak load prices once including negative prices and once with negative prices set to zero. Values for Germany.

4. Conclusion

Subsidy-supported wind and PV generation are increasingly contributing to negative pricing events, which distort market signals, create operational inefficiencies, and generate unnecessary fiscal burdens.

While subsidies remain a necessary tool to meet climate targets, they must be recalibrated to reflect the maturity and system impact of the technologies they support. Eliminating or suspending payments during negative pricing hours is a pragmatic first step, while taking into account the negative effects on revenues of curtailed renewables.

Over time, enabling renewable generators to participate fully in price-responsive dispatch will be essential. Paired with the rapid deployment of storage, flexible demand, and grid-enhancing technologies, this approach can preserve market integrity while accelerating the energy transition.

References

All price and generation data for Europe and Germany: Energy Charts (Fraunhofer ISE) – https://www.energy-charts.info