1. Introduction

Electricity is a unique commodity as it must be produced and consumed in real-time. This requires a sophisticated market structure to ensure continuous balance. Over time, various market mechanisms have been developed to manage electricity trading, optimize dispatch, and ensure system stability.

2. Liberalization and Creation of Markets

Monopolies At the beginning of electrification, power companies began constructing power plants and directly connecting consumers willing to pay for electricity. Over time, these companies expanded their networks, linking more customers and forming the foundations of the modern electricity grid.

As these grids grew, power companies evolved into natural monopolies—a situation where a single provider dominates the market because duplicating the infrastructure would be economically inefficient. The high capital costs of building parallel grids prevented competitors from entering the market, effectively locking in consumers to the existing utility.

Due to their monopolistic position, these utilities required strong government oversight. Around the world, electricity companies were either heavily regulated or state-owned, ensuring that critical infrastructure remained operational and electricity remained accessible to the public.

Liberalization State-owned monopolies often lacked competitive pressure, leading to inefficiencies in cost management and investment as well as a lack of innovation. Recognizing the need for a more efficient and competitive electricity sector, the European Union began the process of power market liberalization in 1996 with the First Electricity Directive. This initiative aimed to break up the monopolistic structure of utilities and introduce market-based competition.

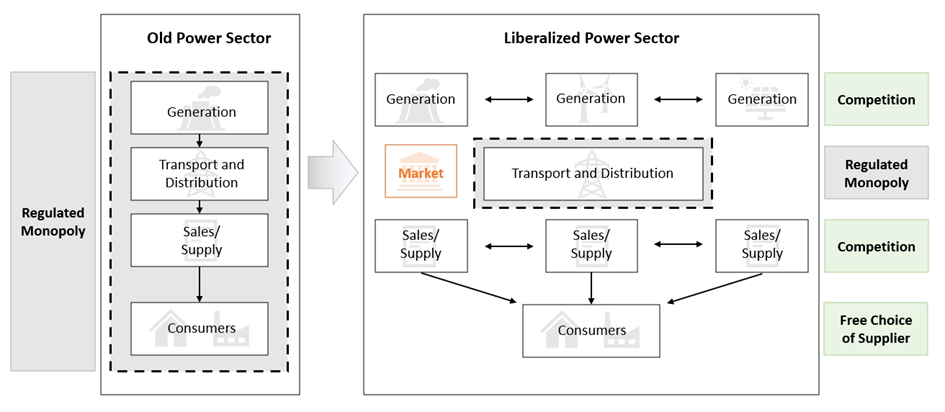

A key principle of liberalization was unbundling, which required vertically integrated utilities to separate their grid operations from competitive activities like power generation and electricity supply:

Power generation became an open market, allowing companies to invest in new and more efficient power plants.

Electricity supply (retail sales) was opened to competition, giving consumers the freedom to choose their electricity provider.

Grid infrastructure remained a regulated natural monopoly, ensuring fair and non-discriminatory access to all market participants.

With the liberalization of electricity markets, a new need emerged: a marketplace where electricity could be traded between generators, suppliers, and large consumers. This led to the development of organized electricity markets, ensuring that pricing transparency and efficiency.

Graph: Differences in the old and the new, liberalized power sector

3. The Role of Market Mechanisms

Balancing Supply and Demand With the liberalization of electricity markets, the responsibility for maintaining grid stability shifted to independent entities known as Transmission System Operators (TSOs). Their primary task is to ensure that electricity supply matches demand at all time, keeping the power system stable and reliable.

Electricity grids operate at a constant frequency (50 Hz in most European systems), which can only be maintained if the amount of electricity injected into the grid equals the amount consumed at every second of the day. Deviations from this balance can lead to frequency fluctuations, which, if severe, can result in grid failures or even blackouts.

To prevent this, TSOs strictly monitor all connected market participants and enforce a principle known as balancing. Every generator and electricity supplier must ensure that the amount of electricity they produce or procure matches their actual consumption or sales within their designated balancing area. This process is called self-balancing and forms the foundation of system stability.

Market participants use electricity markets—such as the Day-Ahead, Intraday, and Balancing markets—to adjust their positions and match supply with demand in the most economically efficient way. The time period within which each balancing party must be in equilibrium is known as the Imbalance Settlement Period (ISP), which is set at 15 minutes in most European countries.

Product While electricity itself is a uniform product—one kilowatt-hour (kWh) is identical regardless of the source—it gains market value through two key factors: time and location.

Time → Electricity prices fluctuate based on supply and demand at any given moment. A megawatt-hour (MWh) produced during peak demand hours has a much higher value than the same amount of energy generated when demand is low.

Location → The physical limitations of the power grid mean that electricity prices vary across different market areas. A unit of electricity produced in one region does not hold the same value as one generated in another, if transmission capacity between those areas is constrained.

These two characteristics are what defines electricity as a product.

4. Different Markets and their Functions

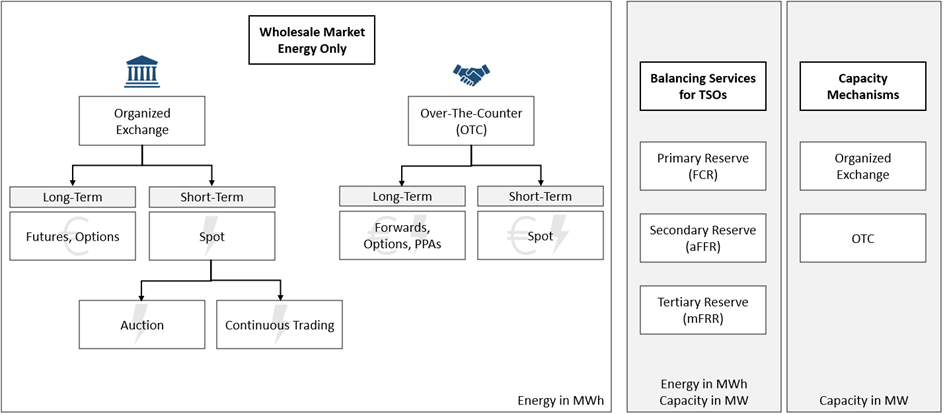

In a classical Energy-Only Market (EOM), electricity is traded as a commodity in megawatt-hours (MWh). Because electricity cannot be stored easily at scale and must be generated and consumed in real-time, its value is defined by two key characteristics: time and location. These factors create different market products.

Beyond the Energy-Only Market, there are additional market-based mechanisms that support the functioning of the power system. These include:

Balancing Services Markets → In order to ensure balancing of the grid, TSOs procure ancillary services such as frequency reserves that can be used in case of imbalance.

Capacity Mechanisms → In some countries, an additional mechanism exists where the product is not delivered energy (MWh) but rather available generation capacity (MW) over a specified period. This mechanism ensures that enough generation capacity is available to meet demand, even if energy prices are too low to incentivize investment in flexible or backup power plants.

Graph: Overview of the different markets for electricity

The different markets are necessary for a functioning market based power system. The following describes, what each of the markets is used for:

Spot Market – Auction-Based Trading The Day-Ahead auction is the first market for physical electricity delivery. It takes place daily at 12:00 CET, allowing producers and consumers to trade electricity for the following day based on their forecasted generation and consumption. The auction mechanism consolidates market liquidity into a single clearing process, ensuring efficient price discovery. Due to high liquidity and forecast accuracy, the Day-Ahead market provides reliable price signals. In addition to the main Day-Ahead auction, there are Intraday auctions closer to delivery, allowing participants to refine their positions.

Example: A factory purchases electricity on the Day Ahead auction to match their forecasted production schedule of the following day.

Spot Market – Continuous Intraday Trading: As actual electricity delivery approaches, market participants can improve their forecasts and adjust their positions through continuous intraday trading. Unlike auctions, intraday trading operates continuously, meaning trades are executed on a first-come, first-served basis rather than at a single clearing price. Trading remains open until just a few minutes before delivery (in most European markets, up to 5 minutes prior), allowing last-minute adjustments.

Example: A solar farm sold their expected output based on weather forecasts of the day before. An hour before delivery, weather forecasts change and the farm needs to adapt its positions.

Futures: The spot market is highly volatile, with electricity prices fluctuating significantly across hours, days, and seasons. The futures market provides a tool for market participants to hedge price risks by locking in prices for future delivery. Futures are financial contracts traded on organized exchanges.

A futures contract ensures that the difference between the agreed price and the actual spot market price is settled financially. This allows market participants to plan ahead, ensuring cost predictability for consumers and revenue stability for generators.

Example: An electricity supplier offers their customers a fixed price for two years. To hedge against future price fluctuations, the supplier buys electricity futures contracts that cover this period.

OTC: In addition to organized exchanges, market participants can directly negotiate bilateral contracts, known as Over-the-Counter (OTC) trading. These contracts provide flexibility in contract terms, pricing structures, and risk-sharing mechanisms as they do not rely on centralized market mechanisms. One common form of an OTC contract is a Power Purchase Agreement (PPA), where a buyer (e.g., an industrial consumer) agrees to purchase electricity from a producer at a fixed price for a long-term period.

Example: To secure financing for a new wind farm, a developer signs a PPA with an industrial company that agrees to purchase its electricity at a fixed price over 15 years

Balancing Services: Since Transmission System Operators (TSOs) cannot own generation assets, they must procure essential grid services from market participants. Balancing services are TSO-procured reserves that ensure real-time grid stability by adjusting electricity supply or demand to maintain a stable frequency and compensate for unforeseen fluctuations in generation or consumption.

Procurement occurs through market-based auctions, where the lowest-cost providers are awarded contracts. This creates an additional revenue stream for generators and large consumers that can offer flexibility.

Example: A hydropower plant can ramp up or down generation very quickly and sells this ability to the grid operator that can make use of it when needed.

Capacity Mechanisms: In an energy-only market, generators are compensated only for the electricity they produce (MWh). However, some countries have introduced capacity mechanisms to ensure that enough dispatchable generation capacity (MW) is available at all times, even when energy prices are low. In France, the capacity market operates as a decentralized obligation scheme, where electricity suppliers must secure capacity certificates to prove they can meet peak demand. Generators receive capacity certificates for committing to be available during peak periods. These certificates are then traded in organized auctions, where suppliers purchase them to comply with their obligations.

Other countries, such as the UK, use a centralized capacity auction, where generators bid for contracts guaranteeing availability during system stress events.

Example: A French factory expects to have a peak load during winter months of 100 MW and buys certificates of 100 MW from a nuclear power plant.

5. Organized Exchange vs. OTC

When trading electricity, market participants can either use an organized exchange or engage in Over-the-Counter (OTC) trading, where transactions occur directly between two parties. In practice, many companies use a combination of both.

There are key differences between these two trading methods:

Settlement & Counterparty Risk: In an organized exchange, the exchange itself acts as a Central Counterparty (CCP), guaranteeing both financial and physical settlement of trades. In OTC trading, the counterparty is the direct trading partner, meaning there is a risk that they may default on payment or delivery obligations.

Product Standardization: Organized exchange products are highly standardized to ensure high liquidity and efficient trading. OTC contracts offer greater flexibility, allowing parties to customize contract terms, including volume, price structure, and duration.

Market Transparency: Organized exchanges are highly regulated, with market results and price data publicly available, enhancing price transparency. OTC trades have lower transparency requirements, making them less visible to the market. Since exchange-traded prices reflect liquid, standardized trades, they often serve as a benchmark for OTC transactions.

Both trading methods play an essential role in electricity markets.

6. Market Liquidity and Market Areas

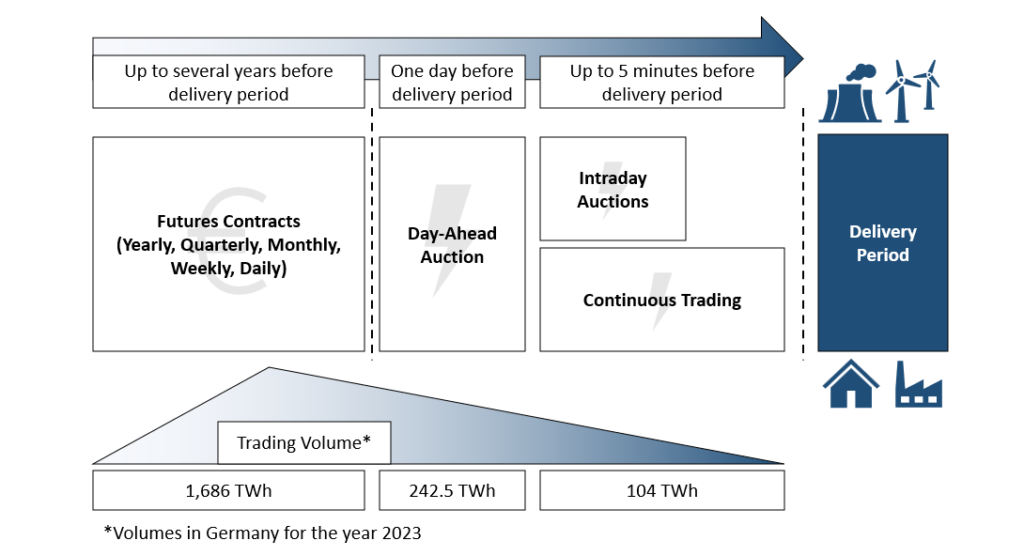

The graph below illustrates the timing, delivery periods, and trading volumes of different organized electricity markets. In the spot market, the majority of trading activity occurs in the Day-Ahead Auction, which takes place daily at 12:00 CET. This auction is the primary mechanism for physical electricity trading, providing a transparent price signal for the next day’s delivery. By contrast, futures markets handle significantly higher trading volumes than the spot market. Futures contracts allow market participants to hedge price risks over longer timeframes, with year-ahead contracts typically being the most liquid. These contracts are actively traded well before the delivery period, ensuring price stability and risk management for both generators and consumers.

Graph: The different organized exchanges in a timeline, Market volumes for Germany

Source for volumes: Monitoringbericht BNetzA, URL: https://data.bundesnetzagentur.de/Bundesnetzagentur/SharedDocs/Mediathek/Monitoringberichte/MonitoringberichtEnergie2023.pdf

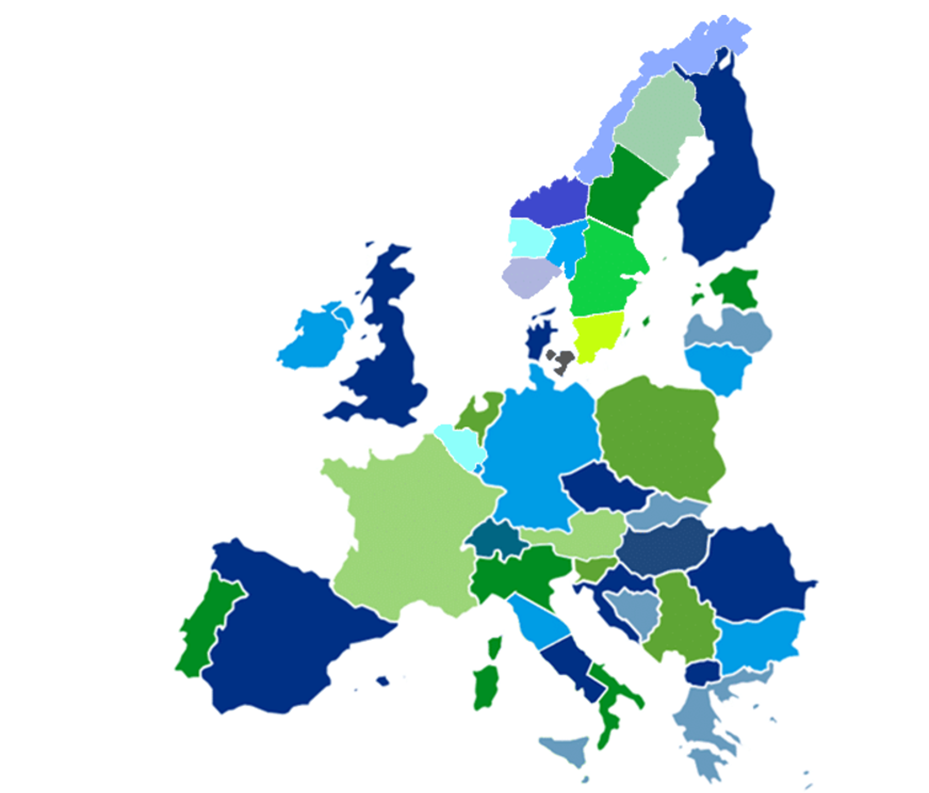

Market Area A Market Area, also referred to as a Bidding Zone, is a geographical region where electricity is traded at a uniform price, regardless of the location of generators or consumers within that area. This uniform pricing is only feasible when the transmission grid within the region is sufficiently interconnected, allowing electricity to flow freely without major congestion.

Balancing Areas Market areas are typically aligned with balancing areas, which are regions managed by a Transmission System Operator (TSO) to ensure grid stability. In most European countries, the market area and balancing area are identical. However, Germany is an exception, as it operates with four separate balancing areas that collectively form a single market area. This setup is unique and reflects the country’s complex grid infrastructure. The following graphic shows the European market areas in 2025. Italy, Sweden and Denmark have different bidding zones within their national borders. This is due to internal transmission bottlenecks, which prevent unrestricted electricity flow between regions.

Graph: Map of Market Areas (bidding zones) in Europe

Source: Florence School of Regulation (14/09/2020), URL: https://fsr.eui.eu/electricity-markets-in-the-eu/

7. Conclusion

The power system has evolved from regulated monopolies to competitive, multi-layered trading systems designed to ensure efficiency, stability, and security of supply.

Spot markets optimize real-time dispatch and price formation.

Futures and Forward markets provide hedging tools to mitigate price volatility.

Balancing services and capacity mechanisms ensure grid stability and backup generation availability.