1. Introduction

Electricity auction markets follow established economic models for price formation, where prices are determined by the interaction of supply and demand. These principles are applied in real-time to determine market-clearing prices and volumes in the electricity market.

In each auction, market participants submit bids to buy or sell electricity at different prices. The final price is determined at the equilibrium point, where supply and demand intersect, ensuring a single market-clearing price for all transactions. This mechanism optimizes economic efficiency by maximizing overall market welfare.

2. Economic Model and Price Formation

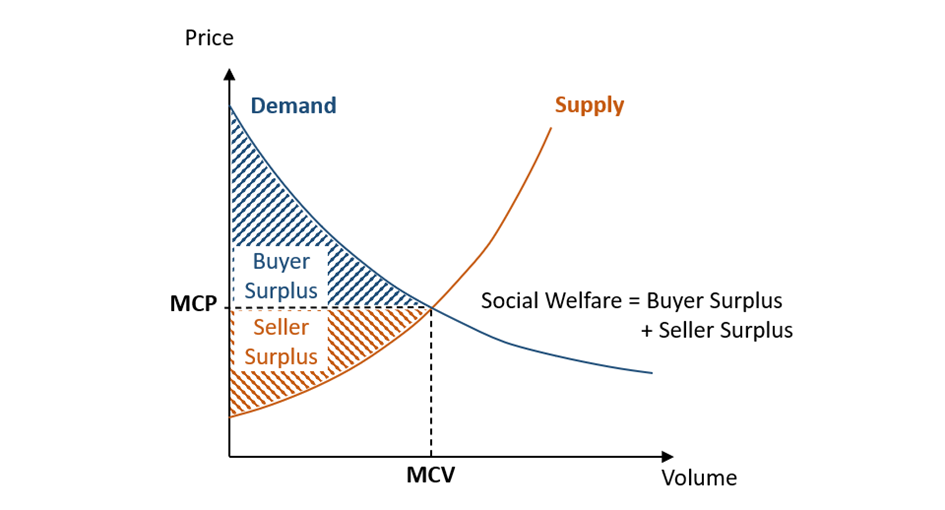

Single Market The electricity auction mechanism follows classic supply and demand principles.

The demand curve reflects buyers’ willingness to purchase electricity at different price levels—fewer buyers accept high prices, while demand increases as prices decrease.

The supply curve represents sellers’ willingness to generate and sell electricity—low-cost generators bid first, and higher-cost generators enter the market as prices rise.

The intersection of those two curves represents the market equilibrium with a Market Clearing Price (MCP) and Market Clearing Volume (MCV).

From an economic perspective, the efficiency of a market can be measured by the following metrics:

Seller Surplus is the difference between the price a seller is willing to accept and the market-clearing price they receive.

Buyer Surplus is the difference between what a buyer was willing to pay and the price they actually pay.

Social Welfare is the sum of Seller Surplus + Buyer Surplus, representing overall market efficiency.

Graph: Supply and demand curve, social welfare

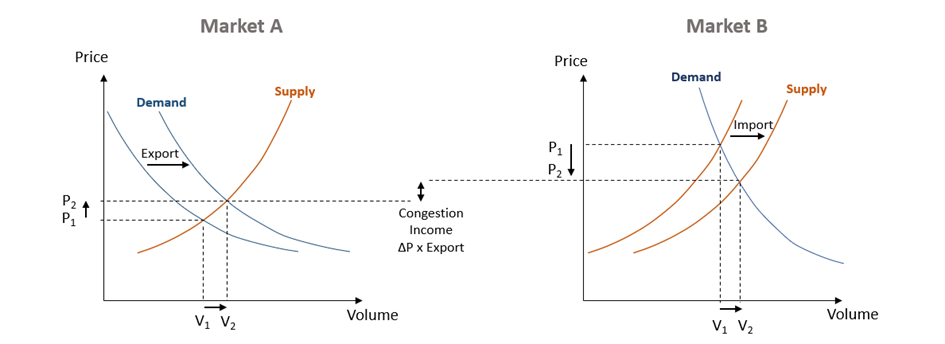

Coupled Markets The European electricity market operates as a system of coupled auctions, where individual markets are connected through cross-border interconnectors. This system requires an extension of the single market model.

In a coupled market, electricity usually flows from low-price areas to high-price areas, which affects the supply and demand curves in each region:

The exporting market (low-price area) experiences an increase in demand (shift in the demand curve). The importing market (high-price area) benefits from an increased supply (shift in the supply curve). This process increases traded volumes and overall social welfare in both markets. The graph below shows how the export out of Market A and import into Market B leads to higher volume and social welfare in both markets.

However, when interconnector capacity is limited, not all excess electricity can flow freely, resulting in price differences between markets. This creates congestion income, which is collected by Transmission System Operators (TSOs) and reinvested into grid expansion to reduce future congestion.

The global social welfare in a system of coupled markets is therefore:

Buyer Surplus of each market + Seller Surplus of each market + Sum of congestion income of all interconnectors. This is what the price-finding algorithm is optimizing for.

Graph: Effects of im-& exports between two coupled markets

3. Algorithm-Based Price Calculation

Algorithm EUPHEMIA (EU + Pan-European Hybrid Electricity Market Integration Algorithm) is the common algorithm used by NEMOs to calculate market-clearing prices across Europe. Its goal is to:

Maximize social welfare of the whole system (buyer surplus + seller surplus + congestion income), while respecting grid constraints and available interconnector capacities.

Input The algorithm takes in all orders from all NEMOs (linear + block orders) and the information about the interconnector capacities between all market areas of the delivery day.

Optimization Once all input data is collected, EUPHEMIA optimizes market outcomes based on two key decision variables:

Cross-border electricity flows (determining im- and exports of each market area)

Execution of block orders (deciding which block orders are accepted or rejected)

The optimization follows a two-step approach:

Quadratic Programming (QP) Optimization: The algorithm first solves a simplified problem, optimizing prices and volumes without considering block orders.

Branch-and-Cut Algorithm for Block Orders: Block orders introduce constraints (either fully accepted or rejected). If a block is partially accepted in the QP stage (which violates its condition), the algorithm branches into two new subproblems: One where the block is fully accepted and one where the block is fully rejected.

This process repeats until the time limit is reached or until all feasible solutions have been found.

Results Once the algorithm finished, the best solution will be taken as market results.

Then NEMOs validate that the results match their orders and TSOs validate that interconnector flows do not exceed capacity limits. Once validated, the results become final, and trades are nominated for financial settlement and physical delivery

4. Conclusion

The auction-based price formation mechanism ensures efficient, transparent, and competitive electricity markets by leveraging fundamental economic principles. Auctions consolidate liquidity at a single point in time, enabling prices to reflect actual supply, demand, and grid constraints. At the core of this system is the EUPHEMIA algorithm, which optimizes market outcomes by maximizing social welfare, ensuring cross-border electricity flows are economically efficient, and maintaining grid stability.